In the incredibly volatility seen this week, we’ve seen some interesting trends and news items in sustainable investment. The pressure in the market is something of a day of reckoning for sustainable investment, as some critics might imagine that ESG credentials take second place when capital preservation becomes the priority. But so far ESG investment is showing itself to be sticky and attracting new investment from long-term investors during this volatile period. It’s a sign that ESG funds are making their way into model portfolios and long-term allocation strategies from advisors.

- During the draw-down in the week ending Feb 28th, European-listed ESG ETFs saw 723 million euros in inflows, the highest of any smart beta category. Similarly US ESG equity ETFs saw $351m in inflows. Only 8% of US ESG ETFs saw outflows vs 22% of all US ETFs

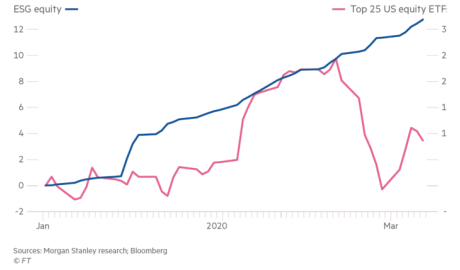

- YTD flows to ESG ETFs on both fixed-income and equities have held up much better than non-ESG ETFs. While a fragment of the total market, this demonstrates an ongoing interest and commitment to ESG investment.

Performance is also holding up for ESG indexes YTD. MSCI ESG Leader indexes in all geographies – World, USA, Emerging Markets and Europe – have outperformed their non-ESG equivalents YTD. In Europe the outperformance has reached 180bps. This doesn’t reflect a different sector weighting, these indexes are designed to mirror the sector weightings of the underlying indexes, but instead to invest in the top 50% of ESG scored companies within each industry. It’s interesting that these indexes outperformed during the end of the bull market and are continuing to outperform in a bear market too.

Important Information

The information contained herein is provided for discussion purposes only, is not complete and is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to purchase an interest in securities. QUAERO CAPITAL believes the information contained herein to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions.

The estimates, investment strategies, and views expressed herein are based upon current market conditions and/or data and information provided by third parties and are subject to change without notice. There is no obligation to update, modify or amend these materials or to otherwise notify a reader in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

These materials include certain opinions, statements and projections provided by Quaero capital with respect to the anticipated future performance of certain asset classes. Such opinions, statements and projections reflect significant assumptions and subjective judgments by QUAERO CAPITAL’s management concerning anticipated future events. these forward-looking statements are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond QUAERO CAPITAL’s control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. The data as presented has not been reviewed or approved by any party other than QUAERO CAPITAL.

Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, currency rate or other market or economic measure. Opinions expressed herein may not be shared by all employees of QUAERO CAPITAL and are subject to change without notice.