Once we have cleared up a few misconceptions about small and mid caps, we realise that there are major differences between them and that we can find some real nuggets that have been totally overlooked by the market. This is a particularly good time to be a gold digger.

A jungle with very heterogeneous fauna

Small and mid caps are wrongly considered to be a homogeneous asset class whose members share a number of common characteristics. Yet apart from their size, there is little in common between a family-owned company that has been active in a narrow but profitable niche for several centuries and a start-up that is about to revolutionise the world by creating a new market from scratch but is burning through cash at high speed without any source of income. As in the jungle, there are placid herbivores quietly fattening up out of sight, felines capable of incredible bursts of speed, predators on the lookout for easy prey, and a few scavengers, not to mention some particularly inactive sloths and even dinosaurs!

Misconceptions about small caps

Small and mid caps are often perceived as being riskier than the market leaders. Because of their smaller size, they are assumed to have less reserves and inertia, and are therefore considered by the market to be more fragile. Here again, one should beware of hasty generalisations. The strength of a company does not depend on its size – one only has to remember a few clay-footed behemoths such as Lehman Brothers, Enron or General Motors – but on the quality of its balance sheet, its equity capital and its position in its market. Of course, there are small caps that are heavily leveraged and fragile, but this is not the case for most small caps. On the contrary, they are often managed conservatively and prudently. For example, the companies we hold in our Small Caps strategy have an average debt to equity ratio of 23%, which is half the average debt to equity ratio of the Stoxx Europe 600 index (46%).

Another common misconception is that European small caps are more exposed to the domestic economy and therefore suffer more from the energy crisis. However, while US small and medium-sized companies are very much focused on the local market, this is not the case for their European counterparts, which often export their products around the world, as is the case in Switzerland.

Smaller stocks outperformed larger ones

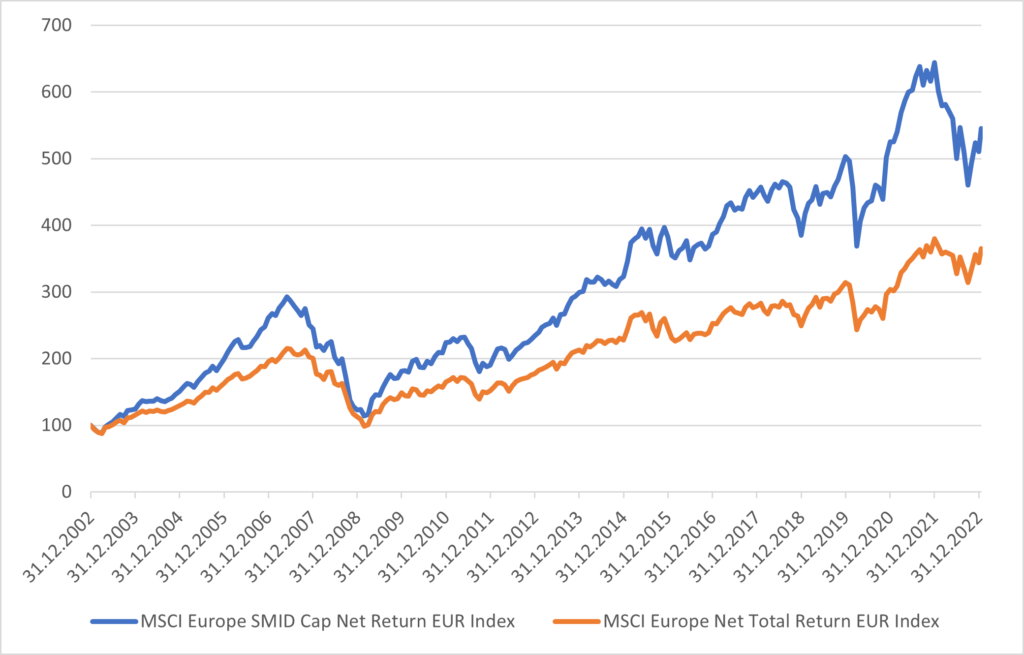

In fact, even if European small and mid caps are less successful than some of the technology stars, their qualities have enabled them to outperform large caps over the long term, resulting in an annualised performance of +8.5% compared to 6.4%[1] as shown in the chart below.

Source : MSCI

Active management can further improve this result, in particular by limiting declines, as was the case in 2022, when it was possible to reduce the decline by half.

And this outperformance is not due to an exceptional year that would compensate for a long period of bad weather. On the contrary: these results are very regular, since, over each 10-year period since 1999, European mid caps have beaten large caps, both in up years and down years[2].

Nuggets overlooked by prospectors

There are 5,385 listed companies in Europe. Of these, 4,201 have a market capitalisation of less than EUR 1 billion. In other words, 78% of listed companies represent only 5% of the total market capitalisation. This is a huge investment universe which, for reasons of cost and lack of investor interest, is only marginally covered by investment banks. As far as we are concerned, almost 30% of the stocks we hold in our portfolio are “orphaned”, i.e. they are not followed by any analyst.

This makes it possible to find excellent deals in the form of high-value companies that are trading at significantly lower valuations than the market average. And by investing in these undervalued companies, one puts into practice the most difficult part of the famous precept of Benjamin Graham, the father of value investing and mentor to Warren Buffet, “buy cheap and sell higher”. Since price aberrations eventually correct themselves, all we have to do is wait for the market to realise the true value of companies.

Now is the right time

Market timing is a particularly perilous exercise in small caps and blue chips alike, and it is often illusory to claim to have found the ideal time to enter or exit the stock market. Nevertheless, the time seems right to invest in European small and mid caps.

First of all, after years of excess that saw some technology stocks reach unjustifiable highs, 2022 was the year of a return to fundamentals. The return of inflation and rising interest rates have brought back to the forefront business models that generate profits in the short term rather than in the distant and uncertain future. Rather than a resurgence of value stocks over growth companies, there is a hopefully more structural shift from ‘growth at any price’ to ‘price matters’.

Indeed, there are currently some excellent bargains to be had and for the first time since the bursting of the internet bubble in 2000 and the subsequent crisis of 2001-2002, we can find so many companies that are worth less than 10 times their earnings. In this respect, the financial ratios of our portfolio speak for themselves: an average Price/Book Value ratio of less than 1.0x, an average PE of 10.7x and a dividend yield of 3.3%.

Follow those who know best

Another convincing indication that small and mid caps are currently undervalued is the behaviour of their family shareholders. In fact, in recent months we have seen founding families decide to buy back their shares to exit the stock market, believing that their shares were really too cheap compared to the prices paid for competitors by private equity players. This has been the case for the Vaud-based packaging machine manufacturer Bobst and the French office equipment distributor Manutan. This is very positive news for investors: not only do they often pay substantial premiums for their takeover bid (60% in the case of Manutan), but it is also a clear sign of confidence in the company’s prospects. Indeed, who better than the founding families know the true value of a company?

Promising themes

The last element in support of an investment in European small and mid caps. Growth on the Old Continent should be supported in the years to come by a number of promising themes, whether it be the growing need for energy infrastructure, the relocation of production to reduce dependence on Asia, the increasing automation of industry or the sharp increase in defence budgets in response to the invasion of Ukraine.

[1] Résultats basés sur les indices MSCI Europe Mid Cap NR et MSCI Europe NR du 31.12.31.12.2002 au 31.12.2022.

[2] Résultats pour les indices MSCI SMID Cap et MSCI Europe Large Cap depuis 2000 jusqu’au 30.09.2022.