The “crisis” we are experiencing is an energy crisis (which primarily concerns gas and coal) and, more generally, a commodities crisis, not just an oil crisis (see graph below), with a certain tendency to stabilise in recent weeks.

The rise in oil prices is massively due to a supply shock since the end of 2021, resulting mainly from the Ukraine-Russia tensions followed by the armed conflict from 24 February.

Beyond that, we should also remember that at the global level, investment in the oil sector has been low for 8 years now, i.e. since the June 2014 peak (Brent price at nearly $110) which was followed by a trend decline until 2021.

Admittedly, OPEC announced a faster increase in production in July and August (+650k each month vs 400k initially expected). In addition, Saudi Arabia (1.5 million barrels per day) has announced that it is ready to do more. Certainly, this is an important signal and shows OPEC’s willingness to ease the tensions on the market.

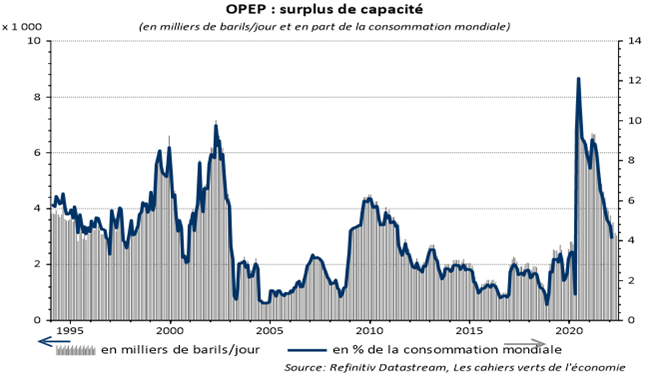

But fundamentally, excess capacity on the OPEC side is being reduced quite rapidly as a result of rising global demand (see chart below).

The latter is supported by the recovery of transport in the developed world (tourism in particular), while the level of stocks (in days of consumption) is low in the Western world.

We therefore expect OPEC to have excess capacity of around 1 to 2 million barrels per day at the end of 2022, i.e. fairly low levels, close to those of summer 2014.

Finally, there is US oil production, which stands at around 12 million barrels per day. It has increased significantly, but is still well below the pre-Covid peak (13 million)

What about the war in Ukraine and the European sanctions against Russian oil? We know that the EU has finally adopted a quasi-total embargo on Russian oil.

With the embargo of other developed countries (G7 countries in particular), it is now about 3 million barrels per day that are affected by the embargo out of a total Russian production of 10 million barrels per day (about 7 million exports in normal times).

The impact of the current embargo is nevertheless partially offset. Firstly, the mobilisation of the US strategic reserves (currently 1 million barrels per day) should be taken into account. Secondly, the recent dynamics of Russian exports indicate a significant redirection of crude oil flows towards Asia.

We can consider that about 4 million barrels per day of Russian oil will be penalised by the embargo and that if we assume a redirection of flows of about 2/3, the net impact on supply would be a little more than 1 million barrels per day. We can consider that this deficit is “predicted” today.

There remains the final world demand. First of all, it is obviously linked to world growth

Of course, we can count on a slowdown in the US (20% of world oil consumption), beyond the driving season, and in Europe (15% of world consumption for the EU). However, we must rely on a fairly sharp rebound in Chinese demand (14%) after the pandemic shock suffered in Q2 2022.

But let us not forget that the rise in oil is also partly due to low coal and gas stocks.

It seems pretty clear that oil remains low by historical standards versus coal and natural gas despite the decline in recent months.

While these energy commodities are not perfectly substitutable (particularly given the constraints of transport and production systems), far from it, the price level in relation to physical properties makes oil attractive a priori vs. gas and coal. This is all the more true as Russian pressure (via Gazprom) is already manifesting itself and should manifest itself again in the middle of next autumn when demand for natural gas will start to rise again.

In short, a quantitative estimate for H2 2022 of USD 110 b/d seems reasonable as things stand.