We are in the middle of the AGM season for most markets and seeing increasing ballots related to environmental and social issues. AGMs represent a very valuable opportunity for investors to challenge the board of directors, as well as use their votes to vote against weak governance structures. As the sustainable investment focus continues to grow, stewardship has become more and more important.

While investing in more sustainable businesses is commendable and an attractive choice long term, influencing companies through proxy voting and engagement is where the industry has the opportunity to alter the course of businesses towards a more sustainable direction.

Regulation changes have supported shareholders having more influence on the companies in which they invest. The ‘Say on pay’ regulation in the UK, Germany, US and other markets for example, ensuring shareholders have the right to vote on the remuneration of executives. While these votes are non-binding, a majority opposition very often results in reflection from the remuneration committee and changes to compensation plans. Opposition to executive compensation is rare, however, despite the inflation of executive salaries far exceeding that of the average employee. Alignment of compensation plans with ESG objectives is becoming increasingly important.

As asset managers become more vocal about certain environmental and social issues, we may see more of the usual agenda items voted against by shareholders in protest. At Quaero Capital we have implemented a voting policy to start opposing boards, committees and directors of companies that are insufficiently addressing climate change. This is already in place to oppose boards that have insufficient diversity. What is important is that companies sufficiently understand why these votes are implemented in order to adjust and respond in the future.

Many proposals but still little support…

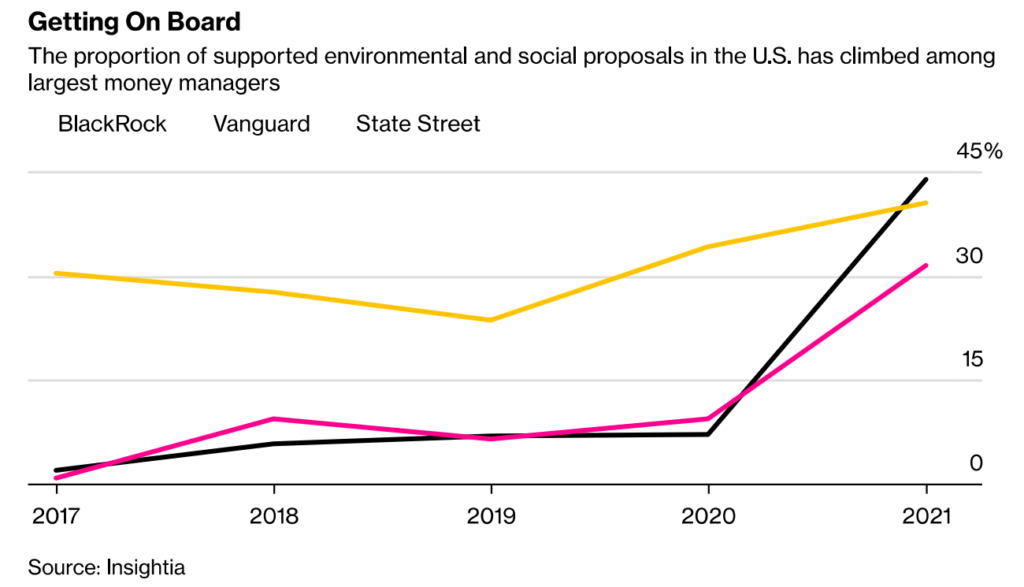

Increasingly investors have the opportunity to vote on other issues raised by shareholders through shareholder proposals. These range widely from civil rights, diversity, working conditions through to biodiversity impacts and climate disclosure. These are once again increasing in number, up 22% so far in the US in 2022, and this trend is likely to continue. However, there is some concern that investors are not following through with their ESG objectives, with only one in three environmental resolutions in 2021 receiving majority support according to ShareAction. This is, however, higher than previously, with only 22% receiving majority support in 2016 according to Bloomberg Intelligence.

While corporate executives aren’t legally obliged to implement shareholder proposals even if they receive majority support, about two thirds of resolutions that get 30-50% support lead to companies partially or fully meeting the requests, according to research from BlackRock.

In the US this week, shareholder proposals at three large banks calling for them to stop fossil-fuel financing won less than 13% of shareholder votes. While a disappointment that there wasn’t a more meaningful support, the issue will remain on the agenda for many years to come and we believe the current energy supply challenges related to the Ukrainian conflict will have affected many voting decisions.

Many bright spots however

There are many bright spots, including more Say on Climate proposals, where Climate strategies are put to investor vote. Holcim became the first cement producer to submit a climate report and hold an advisory vote for shareholders on the Climate strategy. In Europe last month UBS received 75% of shareholder support for their climate plan which includes a target to reduce financing of fossil fuels by two thirds by 2030.

In other cases, the threat of a shareholder proposal on a certain issue can result in action before an AGM. Salesforce is a recent example of this, which adopted a ban on non-disclosure agreements in their employee contracts in the US, an issue that has been pushed onto the agenda for many US companies due to a concern about the impact these can have on worker rights. As you Sow, a top shareholder proposal filer, has withdrawn over 50 petitions this year thanks to companies agreeing to implement strategies in line with the threatened proposal. A recent example is Coca-Cola who agreed to target increased sales of reusable bottles at Coca-Cola.

All in all, the stewardship activity of the asset management industry is increasing significantly. Board of directors are being held to account more for their actions on ESG issues, shareholder proposals are challenging companys’ actions, and we see in our work the impact that has on strategic direction.