A documentary film called ‘Planet of the Humans’ was recently released online to much controversy. For those of you who haven’t seen it, it describes itself as a “full-frontal assault on our sacred cows’, arguing that renewable energy and green movements have been hijacked by the traditional form of capitalism, and that these technologies are not as good for the environment or society as we’re led to believe.

In terms of false facts and narratives, there are many. The film seems unaware of the many evaluations of the life-cycle emissions of renewable energy sources which demonstrate that even with the carbon emissions resulting from the manufacture of wind turbines or solar panels, the emissions-intensity from these energy sources are far lower than those from fossil-fuel generated power. According to research published in the Nature publication two years ago, solar, wind and nuclear provided energy at less than 1/6th of the energy intensity of fossil fuels (and considerably less for projects with high efficiency). Where the film is onto something is that bioenergy was found to be only fractionally less energy-intensive than fossil fuel alternatives.

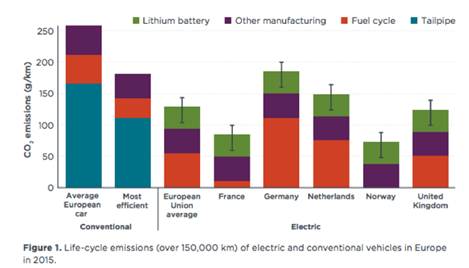

Viewers are also encouraged to be shocked by the fact that electric vehicles (EVs) are often partly powered by fossil-fuels. This is not an unimportant issue, as the location of battery charging will have a significant impact on the lifecycle footprint of the car. But there is a need to step back and review the global efforts underway to reduce the carbon intensity of the grid, and with that EVs are becoming increasingly green. For a reference point an EV charging from the grid in France or Norway, where nuclear and renewables make up a high proportion of the total energy supply, has half the lifecycle emissions as the most efficient conventional car over 150,000km. For Germany the relative emission economics are not so obvious for EVs using the current power mix on the grid; this will obviously change with the closure of coal power plants planned over the coming years. This analysis was done assuming the upper end of estimates on the footprint of the manufacture of an EV battery; with ongoing innovation, this footprint too will change.

Another interesting feature in the news recently, covered by both the FT and Bloomberg, was a study showing that while ESG ETFs are enjoying continued inflows of capital amid strong performance, the ESG might be missing the S. Many of the companies in these ETFs are tech or biotech companies which by nature employ very few people. By investing in companies that are innovating people out of jobs, perhaps these indexes aren’t very ESG at all?

Together these two stories demonstrate the great challenge in sustainability. There are few, if any, companies and supply chains that don’t have some negative impact either on society or the environment. Fingers can easily be pointed to the sourcing of lithium for EV batteries or the jobs lost in the shift to technology. Sustainable investors must manage this complexity and evaluate how these issues are managed, how the company is progressing, and what are the intentions of the strategy and management team.

For ESG ETFs however, this complexity is drilled down to a single ESG figure from a rating agency. On this I couldn’t agree more with the comments this week from Jay Clayton, Chairman of the Securities and Exchange Commission, who is concerned that aggregating ESG analysis into one score is ‘imprecise’ and will fail to deliver on the values that they communicate.

Whether an investment is sustainable is rarely black or white; few companies are either entirely ‘good’ or ‘bad’. Sustainable investment is instead about considering the many shades of grey.

Important Information

The information contained herein is provided for discussion purposes only, is not complete and is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to purchase an interest in securities. QUAERO CAPITAL believes the information contained herein to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions.

The estimates, investment strategies, and views expressed herein are based upon current market conditions and/or data and information provided by third parties and are subject to change without notice. There is no obligation to update, modify or amend these materials or to otherwise notify a reader in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

These materials include certain opinions, statements and projections provided by Quaero capital with respect to the anticipated future performance of certain asset classes. Such opinions, statements and projections reflect significant assumptions and subjective judgments by QUAERO CAPITAL’s management concerning anticipated future events. these forward-looking statements are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond QUAERO CAPITAL’s control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. The data as presented has not been reviewed or approved by any party other than QUAERO CAPITAL.

Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, currency rate or other market or economic measure. Opinions expressed herein may not be shared by all employees of QUAERO CAPITAL and are subject to change without notice.