2023 will be a year of unprecedented policy support.

after the IRA in the US, Europe takes action

European leaders are finally responding to the IRA announced by the US in August 2022. The IRA extends USD 369bn of support to the energy transition focused on local industry and local jobs. Since August, European leaders have expressed concern about being left behind. EU leaders are due to meet in Brussels next month to discuss their response to the US law.

At the World Economic Forum in Davos, EC President Von der Leyen’s speech, set out the imminent launch of the new “Net-Zero Industry Act” which we believe this would essentially constitute a Europe’s own “IRA”. “For the region, this may well represent the most important industry driver in a generation”, according to Mrs Von der Leyen.

In our view, here are the key points: strategic projects along entire supply chains, fast-tracking permitting of new technology production sites, scaling up crucial sectors for reaching net zero such as wind, solar, heat pumps, hydro power, storage, resolving critical mineral dependency on China (The Critical Minerals Act) and employing The EU Sovereignty Fund and other recovery funds earmarked for post -Covid but never used.

Already on 11 January, German Chancellor Olaf Scholz, opened the way for an unprecedented EU initiative: “We need a European industrial investment initiative with a special focus on future technologies, the expansion of renewable energies and the promotion of industrial innovation.”

implications for the sector

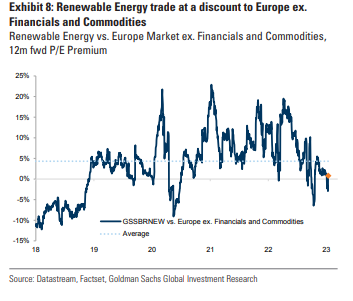

Our conclusion is that low valuations of renewable energy utilities reached during 2022 due to interest rate increases and pessimism about additional capital costs, are exaggerated.

Note that even the Wilderhill NEX Index as a whole is a surprising 17% lower than it was in August 2022 after the announcement of the IRA.

They represent a major part of our investment universe and now appear more attractive than ever. Prior to any additional EU policy support, they are historically cheap (see charts of relative PE vs Europe ex Financials and Commodities). We believe huge additional spending ahead will underscore these discounts and provide an unprecedented investment opportunity.

Graph of the Wilderhill NEX index

Thus after a year 2022 when PE’s contracted and given our own assumptions that inflation and rates are close to peak, we think that the value contraction is done.

In the coming two months we expect the US IRS guidance to unleash vast project investments. On top of this an EU plan will set the stage for even greater spending.

Renewables will benefit from serious tailwinds

Together this trans- Atlantic policy backdrop, IRA plus Net-Zero Industry Act, signals a game changing capex cycle for energy transition but also all other industries that will contribute to the decarbonized future. We foresee the investment universes of both of our funds namely Accessible Clean Energy and Net-Zero Emission funds as significant beneficiaries.