While (almost) all equity markets benefited in 2023 from a major upward movement that often took them to record levels, the small end of the capitalisation spectrum suffered. In fact, European blue chips were up 16% in 2023, mid caps were up 10% and small caps were up 8%, while micro caps fell by 7%!

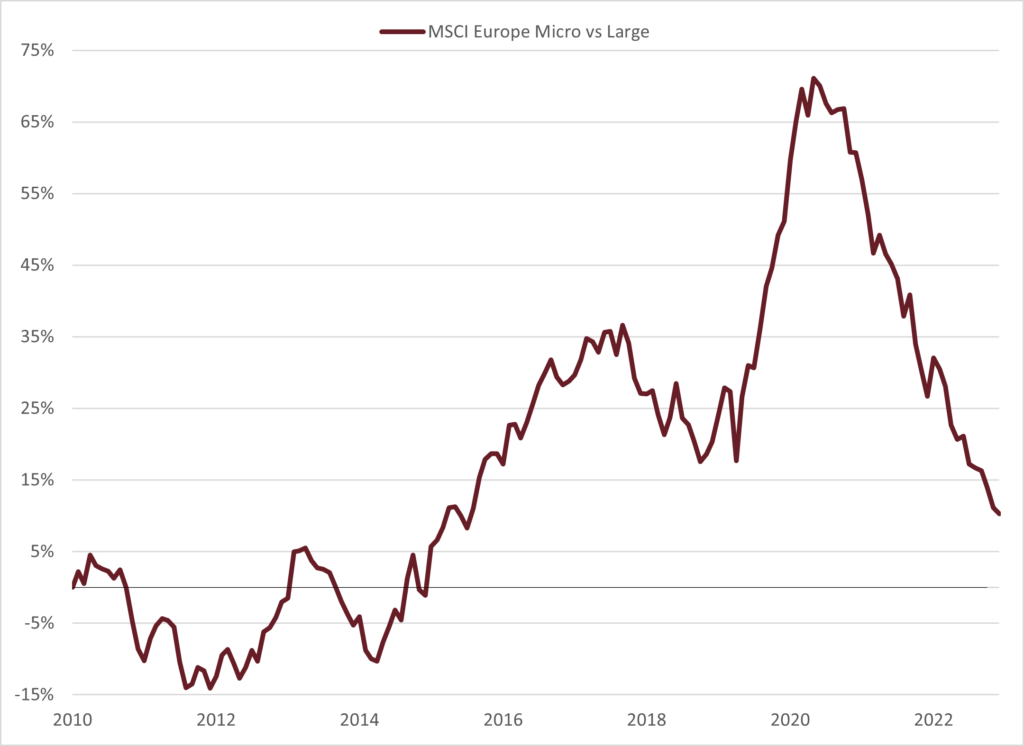

And this underperformance has been going on for several years, as the chart below shows.

Source: MSCI, 2022

Of course, small caps have experienced periods of disaffection in the past, but the current relative underperformance of 25% between the peak of 2021 and the trough of 2023 is historically the longest and strongest since 1995.

Sources: Kepler Cheuvreux, Datastream, 2023

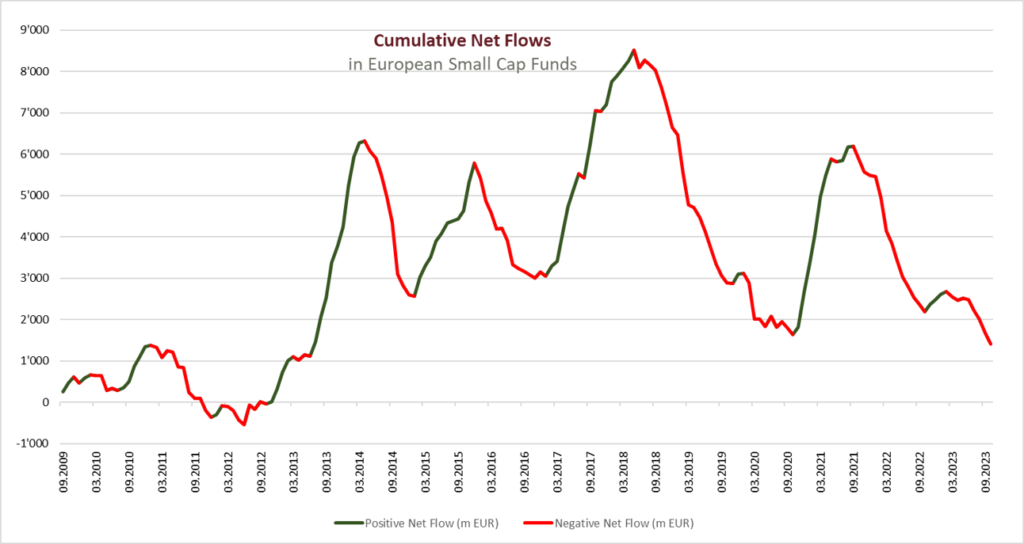

More than for fundamental reasons, this is essentially due to a temporary lack of interest in the asset class, which has been the subject of significant disinvestment. In fact, small-cap funds are experiencing large negative flows which, given the absence of buyers on the market, are translating into significant price falls.

Source: Morningstar, 30.09.2023

It is true that small caps are perceived as being more sensitive to interest rate rises, but this tendency is more marked in the USA than in Europe. Moreover, this perception is not relevant for the stocks in the Argonaut or Swiss Small&Mid Cap portfolios, as the companies concerned have very little debt.

Stocks at sacrificial levels

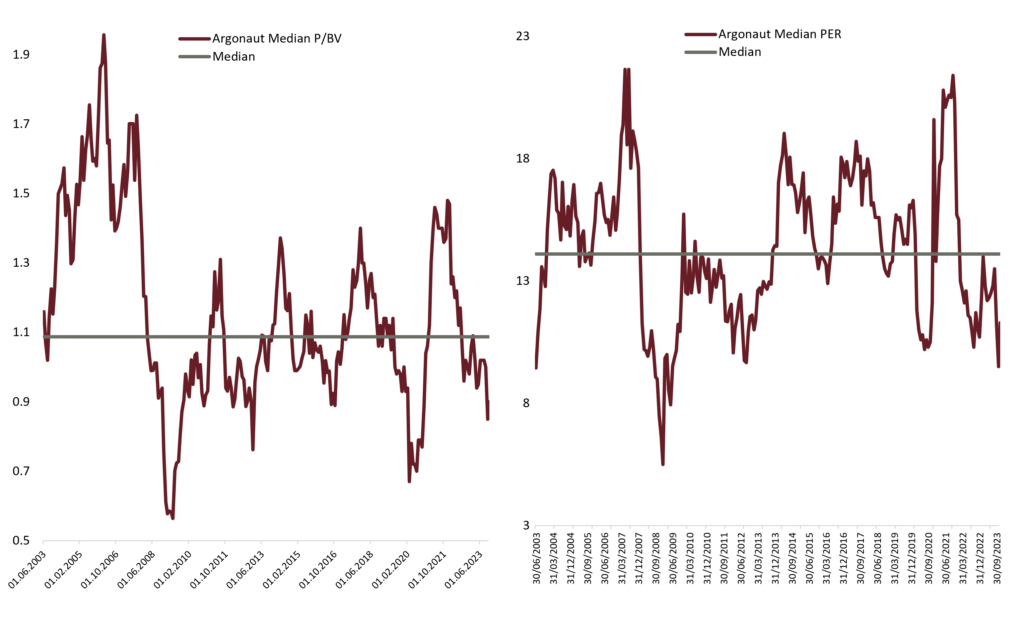

As a result of these price falls, small caps are now largely undervalued compared with large caps, which translates into ratios of 7-8x, or even 5-6x EBITDA for the stocks held in Argonaut. And as can be seen below, the shares held in Argonaut are trading at very low P/BV and PE multiples.

Sources: Capital IQ, Quaero Capital, 30.09.2023

Small caps outperform over the long term

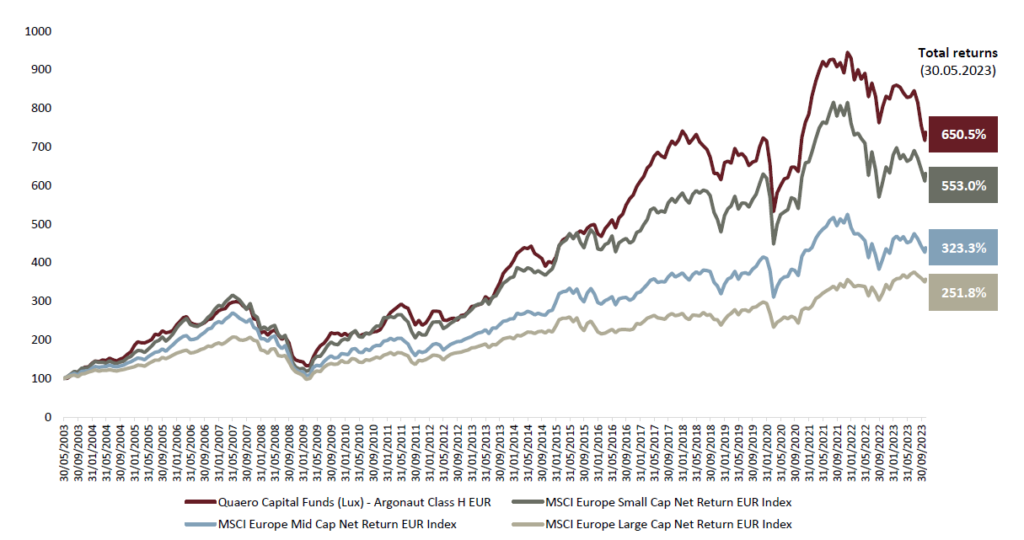

Despite these recent developments, it is important to remember that over the long term, small caps outperform large caps (see chart below).

Sources: MSCI, Quaero Capital, 30.05.2023

For our part, we focus on the least efficient segment of the market, which allows us, through our own fundamental analysis and active engagement with management, to create value by uncovering significantly undervalued companies.

What are the catalysts for a change in trend?

Even if prices are low, they can remain so for a long time if there is no catalyst to trigger a return by investors and a rise in prices.

In this case, there are several factors that could revive interest in small caps:

- Companies buying back their own shares.

- Delisting. In many cases, family shareholders, disappointed by the market’s undervaluation of their company, decide to delist by buying back shares from the public at premiums that can exceed 40%!

- Acquisition by competitors or private equity funds.

- Improving fundamentals. Corporate profits are set to grow by more than 20% in 2024, mainly as a result of higher selling prices and low inventories among customers who were expecting a recession with too much certainty.

It is important to note, however, that there is no need to wait for flows to turn positive before investing. Stock prices move quickly and rise the most at the start of a turnaround. For example, HGears shares jumped 27% in a single day for no apparent reason. For example, between March and December 2009, Argonaut rose by 60% without any subscriptions to small-cap funds.

So it’s not too early to buy!