The rise in interest rates in 2023 has had a negative impact on the infrastructure sector, whose valuation is often closely linked to the discount rate used to assess its value. As a result, the indices concerned underperformed, with the S&P Utilities falling by 10% over the year, compared with a rise of the same order for the Dow Jones Industrials. For its part, the global infrastructure index only just managed to end the year in positive territory (+1%). We are therefore satisfied with the performance of our infrastructure fund, which posted a result of +5.1% for the year 2023, overperforming its benchmark* by 2.9 percentage point.

The challenges of 2024

Fortunately, the global economy is showing signs of slowing down and inflation seems to be on the way down, which has already led to an easing in interest rates that should continue in the coming months. These developments are therefore particularly favourable for infrastructure. In this respect, it is worth noting that, over the past 20 years, this sector has outperformed the market in 68% of periods when interest rates have fallen by more than 10 bp.

For 2024, we expect utilities to perform particularly well, combining low valuations, earnings growth expectations, defensiveness, strong political support and high sensitivity to interest rate movements.

On the political front, however, we should pay close attention to the elections in the USA and the UK in 2024 and in Germany in 2025. While there is a risk that the IRA will be repealed in the event of a Republican victory, it seems difficult to imagine the law being repealed outright, and at most a slowdown in its implementation.

Finally, there are fewer opportunities for consolidation in the sector, as fewer M&A transactions are warranted at present.

Focus on sub-sectors

Telecoms are less buoyant as investment by the big 3 operators slows in the US, even as 5G rollout continues.

As far as electricity generation is concerned, prices are expected to normalise around the world, albeit remaining at a high level.

As for airports, we should not expect strong growth this year after the sharp post-COVID rebound.

In water and waste treatment, pricing power will be decisive, as volumes could fall.

The performance of motorways is likely to vary from case to case, depending on their location.

Our positioning

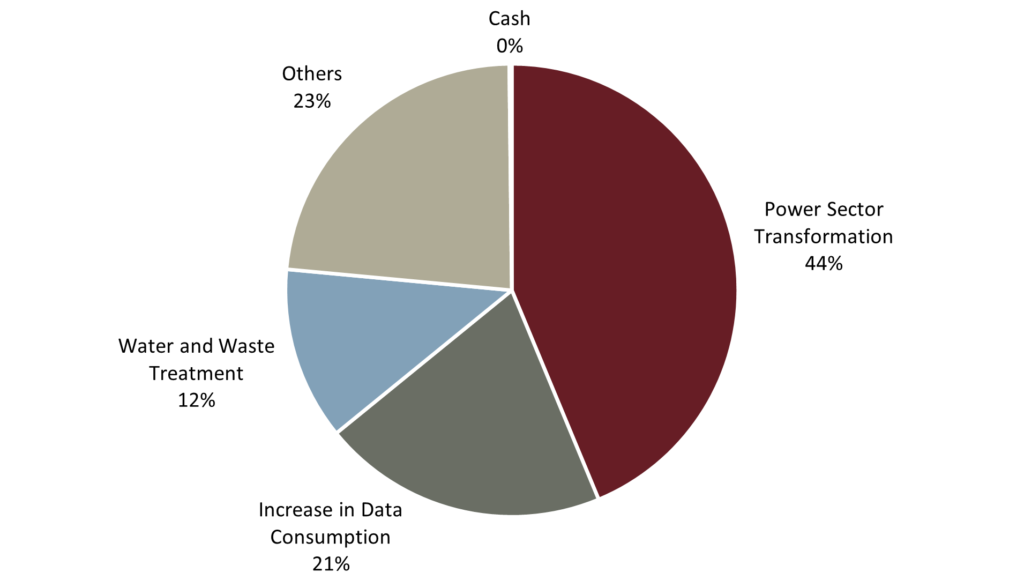

In view of the above, we remain fairly defensive, with limited exposure to airports and pipelines (midstream energy). We also have limited positions in companies with a high refinancing risk. On the other hand, we have greater exposure to interest-rate-sensitive securities, such as telecoms towers, data centres and long-term concessions. These companies account for around 30% of the portfolio. We remain focused on 2 themes that form the core of our allocation: the transformation of the electricity sector (44% of the portfolio) and the global increase in data consumption (21%). Between them, these two themes account for 65% of our portfolio (see below). Finally, we are likely to remain underinvested in renewable energy developers.

Our growth themes for 2024

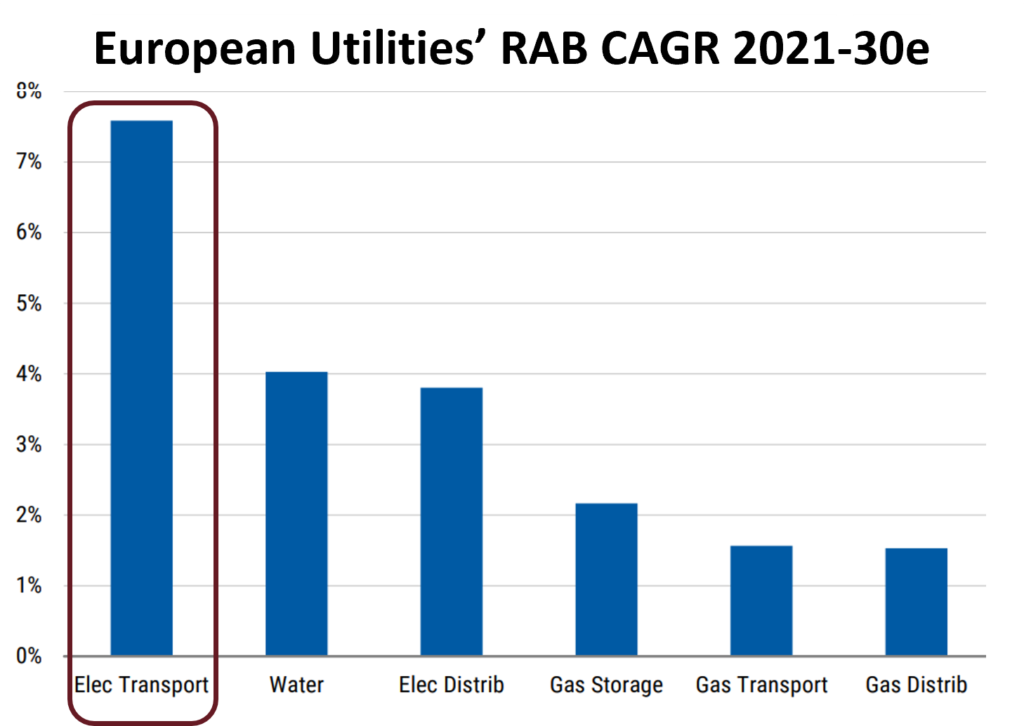

Mobile data consumption is set to increase by 30% a year, which will mainly benefit telecoms antennas, data centres and fibre-optic networks. In addition, every dollar invested in renewable energy generation requires a dollar of investment in electricity transmission and distribution. As the graph below shows, this sector is the most profitable in Europe.

Source: Morgan Stanley, 2023

Given the intermittent nature of renewable energy generation, which depends on wind and sun, this also means significant investment in flexible power generation.

We therefore favour diversified companies active in electricity transmission and distribution, as well as in flexible power generation.

Ready for 2024

We believe that the fund is currently well positioned to benefit from the growing influx of public money finally pouring into the energy transition (IRA, NextGenEU).

The fund should also benefit from the expected fall in interest rates, while being well protected against the economic slowdown.

Infrastructure companies are currently valued at one standard deviation below their long-term average, with an EV/EBITDA ratio of less than 10x compared with an average of around 11x.

Finally, the fund is expected to be less volatile than the broader market.

Note that, with a performance of +5.1% for 2023 (vs +2.2% for its benchmark*), the Infrastructure Securities fund ranks ahead of its peers, thanks to our responsiveness to the various events influencing the sector.

* The benchmark of the fund is S&P Global Infrastructure Euro Net Total Return.