While water seemed inexhaustible almost everywhere in Europe, climate change and the increase in periods of drought have made a scarce commodity a critical resource. To tackle the crisis, major investments are needed, as well as a profound change in our consumption habits.

An essential resource but under pressure

In Europe, each person consumes around 128 litres of water a day[1], so an average of 44.7 billion m3 of water is used by European households every year[2]. And they only account for less than a fifth of consumption, because the biggest consumers are electricity producers (33%), who use water as a means of cooling, agriculture (28%) and industry (18%)[3].

Although water consumption has fallen slightly over the last ten years, the fact remains that it is an increasingly scarce resource. Indeed, while 88% of Europe’s freshwater comes from rivers or groundwater, these sources of supply are extremely vulnerable to the threats posed by overexploitation, pollution and, above all, climate change. In fact, 70% of the population of southern Europe faces a seasonal shortage of water, mainly in summer, and the duration of droughts in Europe has quadrupled in the last 30 years. Access to water could become increasingly difficult in the future, leading to fierce competition between different consumers and the risk of social unrest, as was the case this year in France with the “megabassines” issue.

Where can I find water?

In view of climate disruption, it seems illusory to count on an increase in natural stocks through rainwater and snowmelt. Because even if the excesses of the climate have been multiplying for some time now, with torrential rain and cataclysmic storms, they are not improving the situation – quite the contrary. In fact, falling on soil that is too dry, this excessive rainfall cannot be absorbed, causing flooding and erosion. In addition, global warming is making winters less harsh and less snowy.

So we have to find ways of coping with the shortage elsewhere:

- Reducing consumption. Water must be saved in all sectors of activity, in agriculture and industry as well as in households. This undoubtedly begins with better management of the resource, in particular through more accurate measurement of the volumes withdrawn.

- Improving network efficiency. In Europe, 25% of drinking water circulating in networks is lost. In Spain, this rate is as high as 30% to 40%. The main reason for this is the age of the pipes. In France, for example, the average age is 50 years.

- Use of non-conventional water sources (rainwater harvesting, grey water reuse). In France, less than 1% of the water consumed comes from the reuse of grey water, compared with 8% in Italy and 14% in Spain. In France, it is forbidden to consume rainwater.

- Reducing pollution. In many countries, intensive farming leads to pollution of groundwater and rivers, making the water unsuitable for consumption and reducing the productivity of treatment plants.

A huge need for investment

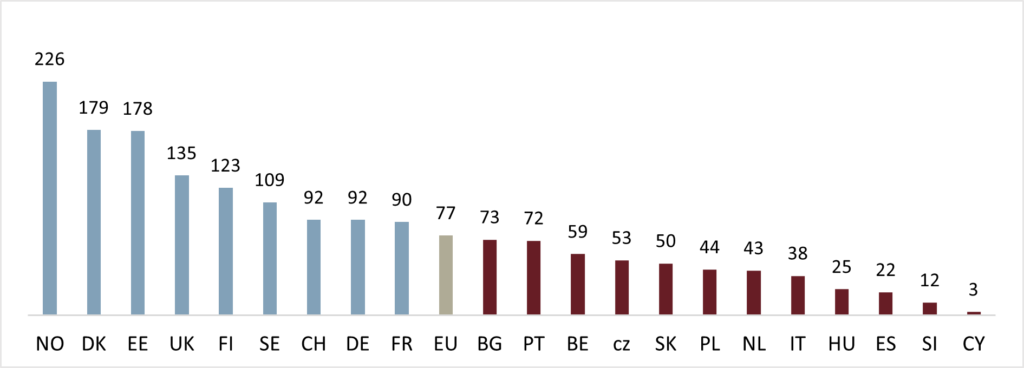

The European Commission estimates that Member States should increase their investment in the water sector from EUR 100 billion in 2020 to EUR 300 billion in 2030, tripling their budgets. Even if there is a significant gap between Member States’ annual investment needs, all European countries should make an additional effort of at least 25% to comply with water infrastructure standards.

Annual investment per inhabitant (in EUR, average over 5 years)

Source: EurEau: European drinking water and waste water sector, 2021 edition

Source: EurEau: European drinking water and waste water sector, 2021 edition

Private investors to the rescue

Historically, 80% of investment in water infrastructure has been financed by public money (State or local authorities). However, many European countries are already heavily indebted and will probably not be able to make the necessary investments in the years to come. What’s more, although EU transfers account for more than 13% of budgets in some countries[4], this European support could well decrease in the future. As a result, private investment and commercial financing, which currently account for only 6% of the total, could well increase significantly.

What opportunities are there for investors?

Several European countries are well suited to private investors and commercial financing. In fact, in many cases, European public funds make it possible to reduce companies’ risks. This is reflected, for example, in legislation that limits political risk, public guarantees that reduce credit risk, long-term concession contracts with high visibility of cash flows or tariffs adapted to inflation. This makes water infrastructure projects attractive both to banks (through project finance) and to private equity investors .

Alongside the major players, the water sector is made up of hundreds of small and medium-sized enterprises that provide essential services to a wide variety of public and private customers. Some have developed niche expertise in their field, cutting-edge technologies and/or special relationships with their customers.

In our view, the best opportunities are to be found in industry, which is under pressure from the public on sustainability issues and needs to modernise its facilities. So there are new markets to be seized, particularly in the areas of reuse and optimising consumption. Utilities also represent an interesting market. They, too, are subject to public and regulatory pressure, and represent a reliable and solid counterpart. New markets in this sector include network modernisation and district heating.

[1] Source: Office français de la biodiversité, Collection des synthèses eaufrance, 2021

[2] Source: EurEau.

[3] Source: European Environment Agency.

[4] Source: ‘Financing a Water secure future’, OECD Policy highlights 2022.