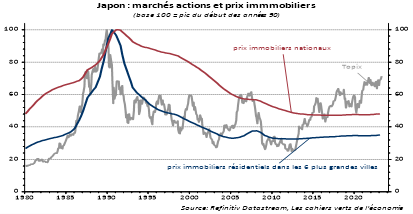

For almost 35 years, Japan has been the victim of the collapse of one of the most gigantic double bubbles in history (real estate and equities), which explains the structural underperformance of the Japanese market for 3 decades (see chart below). The Japanese market now accounts for just over 6% of world stock market capitalisation, compared with over 50% at the peak of the great bubble at the end of 1989.

Although this is not the 1st time in almost 35 years (there have been 20 periods of outperformance of over 10%), the Japanese market has been outperforming (in local currency terms) the global market for many months.

Since the start of the year, the Topix has significantly outperformed the MSCI ACWI, both in local currency and in dollars (see chart below). The outperformance is obviously even stronger in local currency, given the fall in the yen against the USD (~5%).

A breakdown of the Topix’s performance since the start of the year shows that it has come exclusively from an expansion in valuation multiples, as 12-month forward EPS have remained virtually unchanged despite fairly resilient macro growth (GDP growth of 2.7% annualised in Q1) and the fall in the yen.

Catch-up in terms of valuation may continue, as the gap with the other main developed markets remains very wide despite the recent reduction. The risk premium arising from the persistent deflationary pressures in which Japan has been mired since the early 1990s is now being reduced.

Actual inflation and inflation expectations (particularly among corporations) have started to rise again. This is at a time when companies are managing to maintain their margins, through a slightly downward adjustment in real wages despite a rise in nominal wages.

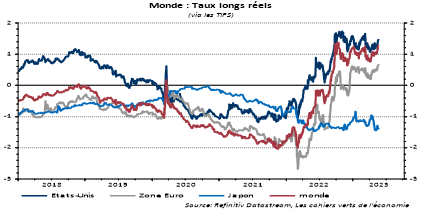

Above all, contrary to expectations, Japanese monetary policy is complacent about this resurgence of inflationary pressures.

The BoJ is still refusing to abandon Yield Curve Control because it is constrained by the level of public and private debt excluding financial institutions (420% of GDP). And insurance companies are bursting at the seams with bonds.

As a result, Japan is the only major rich country to maintain negative real long-term rates (see chart below).

The weakness of Japanese interest rates (and their very strong peg) is encouraging foreign investors (particularly Americans) to adopt currency-hedged investment strategies.

The current short-term interest rate differential guarantees an annualised return of over 5% for US investors.

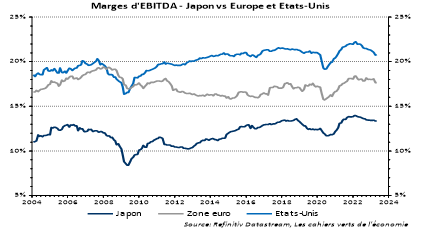

There is also the idea that today’s Japan is benefiting from past structural reforms designed to improve value creation, notably through the adoption of the Corporate Governance Code in 2015. Indeed, it should be noted that these reforms have helped Japanese companies to catch up with their US and European counterparts in terms of EBITDA margins over the last ten years (see chart below).

In fact, the relative yield on Japanese equities compared with US equities has been rising steadily for several years, thanks in particular to the greater attention paid by companies to dividend payments, with a steady rise in dividend yield and payout ratio.

The Japanese market also offers other advantages. Macro growth is fairly resilient, with little likelihood of recession, unlike in the USA or the Eurozone. Moreover, expected EPS growth looks fairly reasonable compared with nominal growth.

There is also no political risk. In addition, investing in the Japanese market can be a way of “playing” China without the China-specific risk premium.

Clearly, the risk for the Japanese market is a rapid rise in the yen, which would lead to a squeeze on EPS and a pullback in the markets.

However, we believe that the yield cushion from currency hedging is significant given the upside risk to the currency.