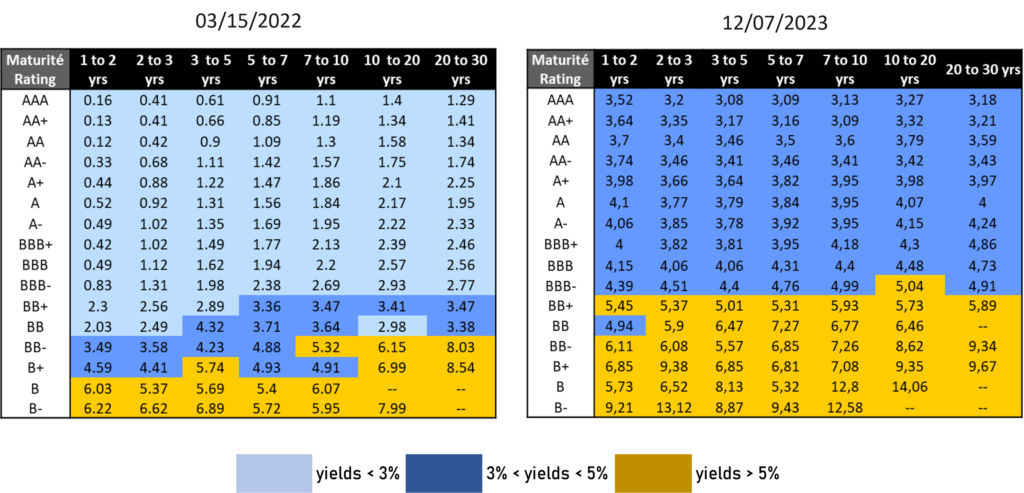

The situation on the euro bond market has changed completely since March. As can be seen from the chart below, while most yields on the various credit qualities and maturities were below 3%, these levels have now completely disappeared. In most cases, yields are between 3% and 5%, and even exceed 5% for ratings below BB+.

If only because of the scale of the movement, bonds should once again attract investor interest in 2024, especially as the volatility of this asset class is much lower.

What are the main challenges for 2024?

As the fund is fully invested, the main risk is a fall in share prices. This risk can be broken down into 2 elements: the risk of a rise in risk-free rates and the risk of credit spreads widening.

On the first front, the question is how likely it is that central banks will raise rates. At present, the consensus is that, after several successive increases in their key rates, central banks will pause or even lower them again. In our view, the major risk, which has not yet been taken into account by the market, is that they will do nothing for a few months and then continue to raise rates in 5-6 months‘ time. This could happen if inflation remains higher than expected and unemployment remains low. This is the most negative scenario for our portfolio at the moment.

The second risk is that of a widening of spreads, which should not be overlooked. For the first time in a long time, we are beginning to see rising default rates on bank loans, particularly in the USA. Many companies have taken advantage of the easing of credit conditions to borrow, but the relative weakness of the economy is raising some concerns. Indeed, we could see a return to tighter credit conditions.

What is our scenario?

We think there will be a pause in rate rises, both at the Fed and the ECB. But this should not obscure the fact that we are facing quantitative tightening that has not yet really begun. Admittedly, the movement has begun, but most of it is still to come.

Moreover, short-term rates are very high (4-5%-5%), but long-term rates remain very low, for no good reason. There really is no convincing explanation for why 10-year yields (averaging around 3.4% for European sovereign debt) are 1% below short-term rates. As a result, we are keeping the duration of our portfolio relatively low, at around 4.

For our part, we expect long-term yields to move within a fairly narrow range of between 2% and 3% for 10-year Bund bonds.

Another point to watch is the default rate, which is starting to rise even though it remains very low by historical standards. The market does not seem to be worried, which is allowing spreads to remain at average levels despite the tightening of credit conditions. We do not fully share this view and are therefore remaining very conservative when it comes to credit quality. As a result, we have upgraded the quality of our portfolio from B to BB+ or even BBB. We are all the more cautious because if an issuer defaults, this often triggers a cascade effect.

On the other hand, we believe that the situation is finally normalising on the yield curve and that the inversion phase is now behind us.

As far as currencies are concerned, we believe that the growth deficit between the USA and Europe should result in a weaker euro against the greenback.

Our positioning

For our portfolio, we are currently favouring medium-term maturities and BBB qualities, as can be seen in the chart below.