2023 will go down in history as a particularly difficult year for the renewable energy sector. The geopolitical situation caused companies involved in fossil fuels, the only ones capable of responding quickly to shortages, to take a dive. Between virtue and the urgent need to find energy sources to replace Russian exports, the market’s choice was quickly made.

In addition, rising interest rates have weighed heavily on the prospects for rooftop solar and on analysts‘ perceptions of the future profitability of many renewable project developers, due to the expected rise in their financing costs. With inflation and the cost of debt on the rise, households are waiting before investing in photovoltaic panels or an electric vehicle.

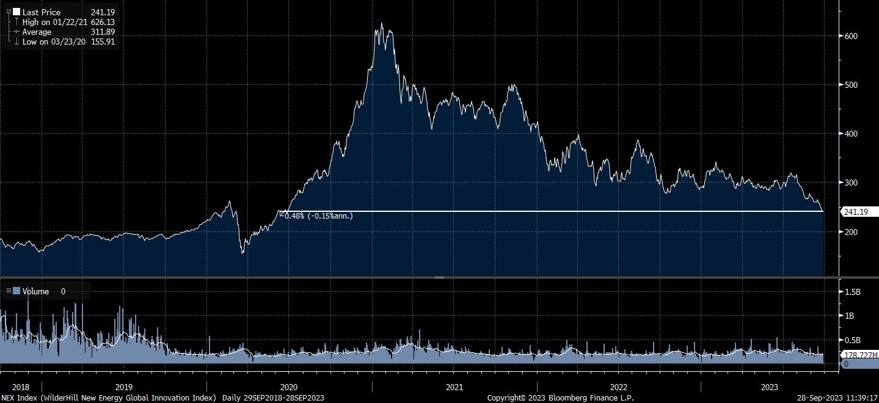

The reality for developers, however, is different. They suffer little from the rise in financing costs because they benefit from long-term index-linked contracts that guarantee them high revenues over 10 to 15 years. Since September, as earnings reports have come in, the market has picked up on the fact that they have remained positive, as can be seen from the chart below, which shows the outperformance of oil stocks since the summer. This upturn is set to continue in the months ahead.

Source: Bloomberg

Key points for 2024

From a macroeconomic point of view, one of the crucial questions is whether the peak of the rate hike has been reached. Indeed, the scenario of an easing of interest rates is clearly positive for clean energy. On the other hand, an economic slowdown would mainly impact the discretionary segment of renewable energies, i.e. household purchases such as rooftop solar panels and electric cars.

On the other hand, the political backdrop remains very favourable to the sector. COP 28 calls for a tripling of renewable energy capacity and a doubling of energy efficiency. We can therefore expect a surge in investment in public services, which will benefit electricity prices and producer margins. Added to this is the IRA law, which provides for the biggest budget in 50 years in this area. Finally, the political situation with China is accelerating the relocation to the USA and Europe of whole sections of the solar energy value chain.

As far as clean energy costs are concerned, economies of scale should enable a return to a downward trend, after the momentary rise in offshore wind production costs recorded in 2023.

The challenges ahead

Electricity requirements will increase to such an extent, whether for renewable energies, electric vehicle charging points or data centres (due in particular to the dazzling development of AI), that it will be absolutely essential to upgrade the centralised electricity network. Investment in this area will therefore have to triple, to USD 870 billion a year.

Another outstanding issue will be the ability of households to buy both solar panels and electric cars. The answer will of course depend on how interest rates evolve, and therefore on the cost of financing these purchases.

China’s reaction will also be crucial. There is every reason to fear that China will decide to slash the price of lithium and photovoltaic panels, in order to reduce its stocks and combat relocation.

Finally, it seems unlikely that the election of a Republican president in November will put a stop to US investment plans. These plans benefit many Republican states by creating jobs, and it would be unpopular to suspend relocation projects.

Our positioning for 2024

Our investment strategy remains unchanged: we focus on mature, profitable technologies with long-term growth prospects and high barriers to entry, and on companies with a solid business model and balance sheet.

In terms of sectors, we retain the same convictions as before, with a preference for solar and decentralised energy generation, energy storage, and energy efficiency, an area in which we are placing particular emphasis.

Of course, we will also take advantage of the recent downturns to seize opportunities to buy undervalued stocks.

Our 4 convictions

We have 4 strong convictions in the portfolio, which we are maintaining and strengthening in the current environment:

- Decentralised solar power generation (DG)

- Disruption to the current centralised grid. Adding storage to DG solar systems accelerates this process.

- No authorisation required, quick installation, no interconnection delays, reliability, growing addressable market.

- Disruptive while adding resilience to the grid at little or no additional cost.

- Aggregate DG: virtual networks (VPP) require no subsidy and offer flexibility to the network.

- Varied financing choices: ‚owning‘ increases home value, ‚renting‘ for cash-strapped customers.

- Political support for decentralised production in the EU and the US. The EU is aiming for 25% autonomous consumption. The IRA offers a 30% tax credit for residential solar systems for 10 years.

- Solar energy and storage are now competitive with utility tariffs when retail electricity prices soar.

- Project developers

- The backbone of the green policy wave.

- Zero marginal cost, IRA support, recharge not yet exploited, economics improved by economies of scale.

- Public-private partnerships fully absorb inflationary investment costs.

- Little change in the 200 basis point spread between IRR and unlevered WACC.

- Acquisition appetite for corporate PPPs in Europe.

- Insufficient electricity supply in Europe means that prices will remain high during the current energy crisis, particularly in countries with a „nuclear problem“.

- Energy storage

- A strategy for accelerating the energy transition.

- The decarbonisation of electricity will require three times as much capacity by 2030, i.e. 11,000 GW compared with 500 MW in 2023, over 90% of which will come from solar and wind energy, representing an increase of 17% per year over the period 2016-2030.

- Political support from the EU and the US for the electrification of energy and transport is triggering massive spending.

- The US Department of Energy is supporting stationary lithium, hydrogen, storage and recharging infrastructure for this purpose.

- A value chain rich in opportunities: from lithium to EHS; from mature technologies to commercially „ready“ innovative technologies.

- Energy efficiency

- Objective: double energy efficiency between 2022 and 2030 (COP28). Goals: energy security, reduction in emissions, reduction in the cost of energy for consumers.

- Grid support is fundamental to transition policies: weather conditions are directly linked to energy consumption (a change of 1 degree in Texas increases electricity consumption by 4%); intermittency.

- Opportunity value chain: from smart grid resource management solutions to bi-directional EV charging solutions, via standardised industrial motors, air conditioners and heat pumps.

Clean energy is cheap and more profitable

As you can see below, the Wilderhill NEX index has returned to its 2020 level. So it’s a good time to buy.

Source: Bloomberg

Especially as there is no turning back on clean energy. On the contrary, the subject is at the top of the agenda for all governments.

Clean energy is therefore on a roll, which will lead to growth and improved profitability: renewable energy consumption is rising, the price of batteries and solar panels is falling, and the economies of scale associated with government schemes such as the IRA have yet to be felt.

Despite these growth prospects, most companies in the sector are undervalued. The Wilderhill NEX index is trading at 15x expected earnings, a discount of almost 30% to the S&P 500.

To sum up, there is a strong secular trend and a growing universe of attractive, highly profitable investment opportunities at deep discounts to price.