Global infrastructure stocks’ performance stood in contrast to broader equity markets in 2023, which rose on the strength of just a few sectors, led by technology (which rallied sharply on optimism surrounding advancements in artificial intelligence).

Long duration infrastructure assets such as toll roads, airports, telephone towers and renewable energy normally perform poorly when the prospects for interest rates are “higher for longer” as cash flows are discounted at a higher rate in equity valuations.

Higher interest rates also negatively affect utility stocks, which tend to be significantly leveraged. Bond proxy stocks suffer as their dividends fail to keep up with money market rates. As a result, listed infrastructure’s valuations have moved below their historical average premium relative to the broad equity market.

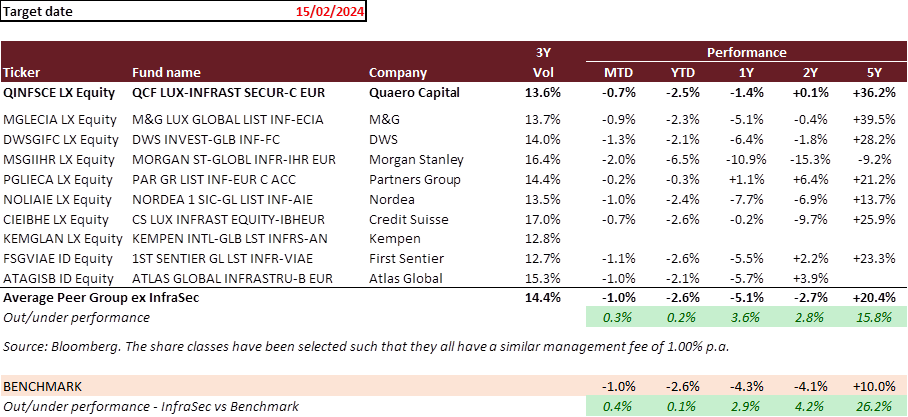

Currently, listed infrastructure equities trade at below 10x EV/EBITDA, one standard deviation below their ten-year average1. The last time infrastructure equities were this cheap for several months was almost a decade ago. Despite the challenging environment, our fund significantly outperformed the benchmark and all but one of the major competing funds.

Outlook 2024 and beyond

As global earnings growth moderates and interest rates stabilise and begin to fall, the backdrop becomes significantly more supportive for our approach to infrastructure investing. Over the past fifty years, infrastructure equities have produced above-average returns when inflation was high but moderating2. Defensive, long-duration infrastructure sectors should outperform as they did in late 2023. Bond proxy equities and stocks representing quality at a reasonable price should also have decent prospects. All three styles are a strong focus of our fund.

Our fund is focussed on investment tailwinds supporting growth in infrastructure, and there is no shortage of these in quoted infrastructure today. The energy transition is probably the major investment theme of the decade, and the least risky approach to exploiting the theme is through infrastructure. We are focussed on the electricity transmission and distribution companies that connect renewable energy sources to the expanding base of power users, the companies who build out the networks of wires, if you will. We have no exposure to renewable developers or unhedged power producers. The explosion of data related to 5G and AI is the other tailwind of the decade, and there we invest in the enablers: the picks and shovels such as telephone towers and data centres. We have no exposure to technology companies. The demand for clean water and sustainable waste management is another strong tailwind we are focussed on.

In the US, the presidential election is a risk factor. We assume that Trump will win. Since it was he who initiated the bi-partisan USD 1 trillion Infrastructure Investment and Jobs Act (passed into law in 2021), he is unlikely to unravel it. These funds are only now being deployed, and the Act will continue to support infrastructure spending in the US for years to come. The Inflation Reduction Act of 2022 which provides USD 900 billion for a variety of initiatives, particularly investing into domestic energy production while promoting clean energy has been a major incentive for the roll-out of wind and solar electricity development in the US and has provided the nuclear power industry with critical support. Although Trump has derided the bill, in discussions we have had with the beneficiaries of the bill, it appears highly unlikely that Trump would attempt to repeal the bill (which benefits “red” states disproportionately), but implementation of certain aspects can be delayed. We conclude that a Trump presidency would have little impact on the fund.

In conclusion, valuations are low, the interest rate cycle is turning in our direction, and three strong visible themes are guiding our sector allocation and stock selection. The next few years should be a great period for our strategy.

Relative performance

The fund’s performance compared to the benchmark and the leading competitors is set out below: