China is one of the few major countries where growth is strongly re-accelerating, inflation is falling and economic policy remains expansionary. Almost all indicators are in the green and the Chinese equity market is globally attractive.

China is one of the few major countries where growth is accelerating strongly again, inflation is falling and economic policy remains expansionary.

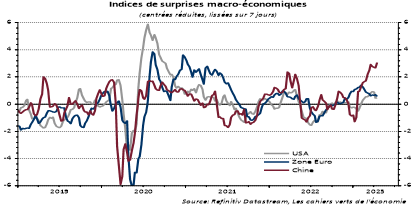

Macroeconomic indicators

All major macroeconomic indicators improved in Q1, well beyond expectations (with the exception of the youth unemployment rate). Of course, post-Covid services spending has soared and in general, private consumption has performed very well with the savings rate falling from 37.6% in Q4 to 32.2% in Q1. More importantly, the decline in residential investment has slowed considerably (-5.8% y-o-y after -16.4% in Q4). Net exports also held up well, thanks to the resilience of demand from Western countries. It is rather private investment that has been relatively disappointing (growth barely above zero year-on-year), unlike public investment (+10%).

On the supply side, it is often the sectors most supported by the authorities that have fuelled the movement: solar batteries (up by more than 50%), electric cars (+22.5% y-o-y), etc.

Today, macro surprises are stabilising at around 3 standard deviations above the average (see chart below).

Real estate

The housing sector is now showing tangible signs of recovery, both in terms of housing starts and sales and in terms of budgetary revenues for local governments.

Average quarterly mortgage rates have continued to ease, ending up at levels not seen in over 20 years. House price growth in major cities is now significant and widespread with a clear rebound in Tier2 cities and below, which account for nearly 90% of the market.

Credit

From a macro-financial perspective, the credit impulse is now more pronounced and will continue to spread. Specifically, consumer credit has recovered for the first time in two years, while credit to non-financial businesses is at its highest since 2012.

What about inflationary pressures?

They are extremely weak. In February, consumer price inflation slowed to 0.7% year-on-year versus a 10-year average of 2.4%. Core inflation also remains very low (0.7%) and producer prices (-2.5%, the lowest since June 2020) are not showing any pressure in the advanced stages of the production process.

Monetary and fiscal policies

This suggests that activity remains below potential and argues for further policy easing. On the monetary front, the PBoC reduced the reserve requirement ratio by 25bp, which surprised the consensus.

Above all, this suggests that a cut in benchmark rates (1-year and 5-year) should not be ruled out while the 7-day repo rate is still on its 2020-2022 average. This is all the more true as the Fed’s next pause will reduce the pressure on the short rate differential.

Fiscal support has been slightly stronger than expected (the deficit target has been raised as has the special bond quota).

What about the equity market now?

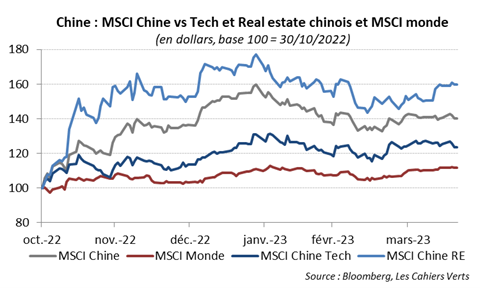

After a „descent into Hell“ in 2021 and 2022 linked to a whole series of factors (Xi’s re-regulation, particularly in tech and real estate, failure of the zero-covid strategy, tensions over Taiwan and with the US), the MSCI China index has been the subject of a powerful rerating since last autumn.

In total, the MSCI China index has outperformed the world since mid-October, while consolidating slightly since the beginning of the year. Within MSCI China, real estate has outperformed and tech has underperformed (see chart below).

What about the Chinese market as a whole?

The absolute valuation of the market remains quite attractive. The Chinese equity market is trading at 10.9x 12-month forward EPS, 4% below the 10-year average (see chart below).

As for EPS forecasts over the next year, they seem quite reasonable with an expected increase of +19% and a level slightly above the long-term trend. This does not seem excessive given the reopening dynamics of the Chinese economy and an accommodating economic policy.

Overall, the Chinese equity market remains attractive.