Looking back to 2023

The restructuring of Japanese companies, which began a decade ago with the aim of improving profitability, cash flow and returns to shareholders, accelerated last year under the impetus of a wave of management buy-outs, hostile takeovers and interventions by activist shareholders. In 2023, for example, activist shareholders forced companies to make payments to their shareholders on sixty occasions.

The Tokyo Stock Exchange has also supported the movement by issuing strict governance rules for listing on the Prime Market and by forcing companies trading below their book value to buy back their own shares and increase their yield. Many family businesses are in the process of launching buyouts, taking advantage of very low bank financing costs. Another positive factor is the unwinding of cross-shareholdings.

As a result, for the first time in decades, the Japanese market is resembling other developed markets. The outlook for 2024 is very positive, as these supportive factors will continue in the years ahead, complemented by the introduction of tax-free equity savings accounts (NISA) in January 2024, which will enable Japanese households to invest in equities.

A few challenges remain

Despite this positive backdrop, a number of challenges remain. Firstly, SMEs are facing increased inflationary pressures and a shortage of labour due to rising wages in the market, which they are unable to keep up with. This will be exacerbated in April by a regulatory change on overtime pay, which is expected to affect infrastructure and distribution.

Finally, it is possible that a new leader of the LDP party will emerge in September, leading to a change of Prime Minister, but this should not impact the market too much.

The different scenarios for 2024

Firstly, we should see an acceleration in the pace of consolidation, with an increase in the number of transactions. This should lead to greater polarisation between companies that strengthen in the process and those that weaken, with divergent stock market performances as a corollary.

GDP growth should continue thanks to domestic consumption and the return of foreign tourists, both of which are at record levels. Thanks to the weak yen, department stores are currently generating three times more sales per foreign tourist than in 2019. In addition, Japanese companies are about to launch major investment programmes, not least as a result of the relocation process.

On the other hand, a sharper-than-expected economic slowdown in the USA could push down the dollar and lead to a fall in profits for some exporting companies. However, unless the yen rises sharply, this fall should remain limited in scale. In this respect, it is interesting to note that dividends are no longer linked directly to profits but are based on a return on equity, which provides good downside protection.

Our positioning

Against this backdrop, the portfolio’s positioning remains unchanged, with a concentration on 20-30 positions. Around a third of the portfolio is invested in stocks linked to domestic consolidation, and we continue to favour market leaders that offer strong cash flow generation.

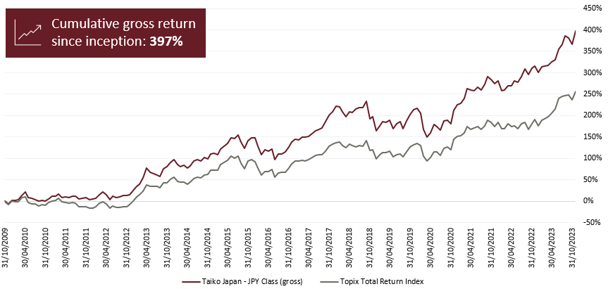

Since the strategy was launched in 2009, we have delivered investors a gross annualised return of +12.1%, compared with +9.4% for the Topix Total Return index. Since becoming a Luxembourg fund in 2020, the fund has achieved a net cumulative performance of +68.5%, compared with +58.5% for the index.