First of all, over 30 years, investing in small caps remains one of the best strategic bets in the global equity market (see chart below).

The small caps bet

First of all, over 30 years, investing in small caps remains one of the best strategic bets in the global equity market (see chart below).

We have already written a great deal about central banks, and we will return to the subject again in this monthly report. On the subject of monetary policy, the borderline between forward-looking analysis and repetitive rhetoric has now been reached. The Swiss National Bank’s (SNB) surprise start to the cycle of key rate cuts does not revisit the subject (the SNB’s decision is also motivated by a problem of overvaluation of the Swiss franc), or even the fashionable thesis that the ECB could finally cut rates before the FED. The duration of a longer-than-expected pause, which has been our scenario since last year, has now been taken on board by the markets. Additional volatility would come from an acceleration in the timing and pace of the downturn. With this in mind, we are comfortable with our ‘cruising’ duration of 4.

The High Yield market has been in turmoil recently and many names continue to be under pressure: Altice, Atos, Grifols, Ardagh and Intrum to name but a few. The latest primary issues are marking time: Pro Group and CBR Fashion, in particular. Only FNAC is doing well.

US long-term yields (T-Note 10Y) have risen by 70bp since the start of the year (including 35bp in the last month), mainly as a result of downward revisions to expectations of future Fed rate cuts. At the start of the year, futures were forecasting more than 6 Fed funds rate cuts by 2024. We are now down to 2, which seems about right. In this sense, the upward movement seen in recent months corresponds to a form of normalisation from excessively low levels at the end of autumn 2023.

Despite a number of disruptive events – the fall of the Berlin Wall, the 1994 bond crash, the Gulf War, the bursting of the dotcom bubble and the collapse of Lehman Brothers – long yields fell almost uninterrupted for more than 30 years between 1990 and 2020, before rising sharply between 2021 and 2023, wiping out almost 10 years of performance. Over these years, the market has undergone a profound transformation, helped by the growing indebtedness of governments. The scope of available instruments has widened. Limited to government debt in 1990, bank, corporate and private debt have since been added to the pool. The instruments have also become more sophisticated, with the arrival and growing importance of futures markets, structured products and, finally, synthetic products, fuelling an increasingly flourishing industry. Hedge funds, thematic funds, index funds, ETFs, total return funds, dated funds – each year brought its cohort of increasingly innovative products.

Corporate governance/changes in the corporate landscape/ shareholder activism are three factors, now well established, that should contribute to a fundamental change in market dynamics.

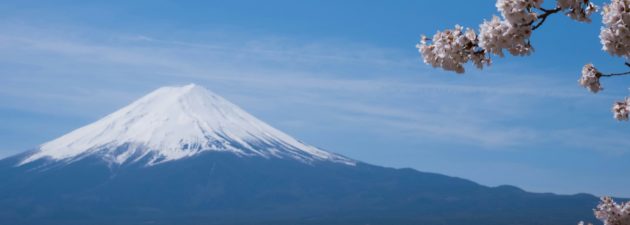

The Japanese market has outperformed the global market in local currency terms over the past 2 years (see chart below).

The fund manager of our japanese equity fund Taiko Japan, Rupert Kimber, recently came back from a trip to Japan. Here are his notes.

This content is available only to some investor categories and no profile has yet been defined. Define your investor profile to access this content.

If we are looking for the principle that guides Jerome Powell in his communication with the markets, we can find it in the boustrophedon style of writing that goes from right to left and then from left to right. Used in archaic Greece until 402 B.C., this type of writing was inspired by the march of an ox marking its furrow in a field.